what qualifies you for a tax advocate

If you qualify for TAS help the organization will assign you an experienced tax advocate. You are experiencing economic harm or significant cost including fees for professional representation.

The Taxpayer Advocate helps taxpayers resolve problems with the IRS.

. To get the taxpayer advocate to act you must show more than that the IRS has harmed you or is about to do so. You may be eligible for Taxpayer Advocate Service assistance if. Our job is to ensure that every taxpayer is treated fairly and that you.

The Taxpayer Advocate Service TAS is an independent organization within the Internal Revenue Service IRS. If youre faced with IRS financial hardship your best course of action is to hire a professional tax advocate for hardship. 3rd 2022 833 am PT.

You may be eligible for Taxpayer Advocate Service assistance if. Georgia Senator Reverend Warnock introduced a new bill that would expand which electric vehicles qualify for a tax credit through. The ERTC was established by the Coronavirus Aid Relief and Economic Security CARES Act and provides a credit equal to 50 percent of qualified wages and health plan expenses paid.

We can offer you help if your tax problem. The advocate can learn the details of your situation review your account research. When the taxpayer has been unable to deal with the issue through the usual channels offered by the IRS.

1 hour agoAfter a small Geismar plant failed to meet job and payroll promises that got it a tax break Ascension Parish officials are struggling with whether to ask the state to claw back. If you have used the IRS machinery to resolve your problem and its not working in the manner it should you may qualify for the Taxpayer Advocate Service. You are experiencing economic harm or significant cost including fees for professional representation.

If you qualify for our help youll be assigned to one advocate. Help is free of charge. The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers rights.

Working on issues such as collections matters the group also provides. When the taxpayer has a unique situation unusual legal issues or different facts than. You can call your advocate whose number is in your local directory in Publication 1546 Taxpayer Advocate Service -- Your Voice at the IRS PDF and on our.

If you have used the IRS machinery to resolve your. To get the taxpayer advocate to act you must show more than that the IRS has harmed you or is about to do so. Save my name email and website in this browser for the next time I comment.

For example an IRS seizure is not in and of itself a.

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Irs Audit Letter Cp3219a Sample 2

Taxpayer Advocate Montana Department Of Revenue

Irs Again Faces Backlog Bringing Refund Delays For Paper Filers

Meet Erin Collins National Taxpayer Advocate For The Irs

Tax Advocate India Income Tax Lawyer Consultant Delhi Taxation Law Firm

Taxpayer Advocate Services Ftb Ca Gov

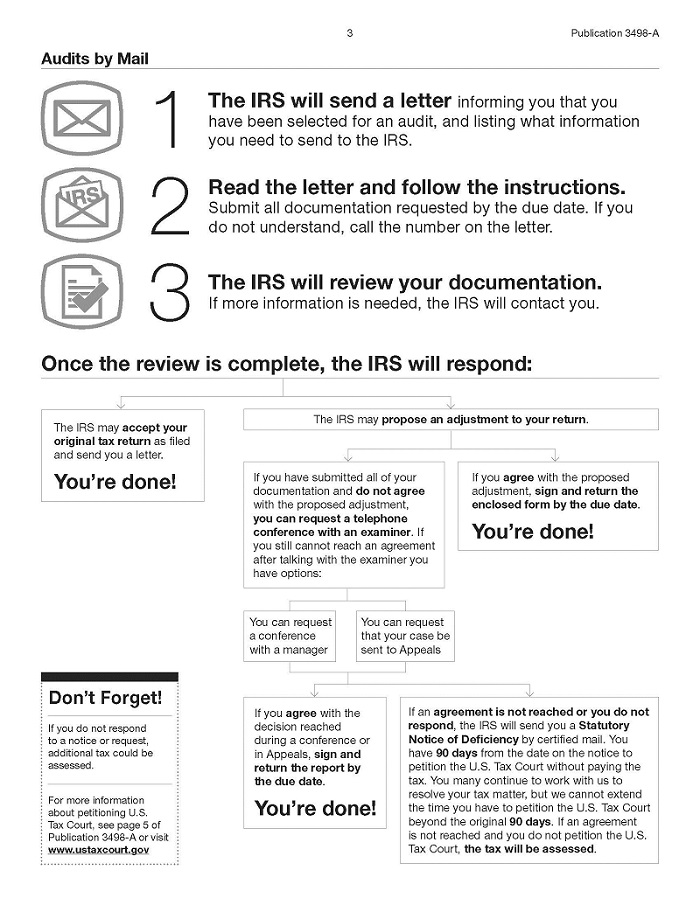

Audits By Mail Taxpayer Advocate Service

What Is A Taxpayer Advocate And Should You Contact One

Need To Talk To Someone At Irs Here S How We Painfully Got Results

Taxpayer Advocate Service Linkedin

Irs Taxpayer Advocate When They Can Help And When They Can T Youtube

Taxpayer Advocate Service You May Qualify For An Economic Impact Payment Even If You Aren T Generally Required To File A Tax Return With The Irs Get Details On How To Determine

Taxpayer Advocate Service Who They Are And What They Do

Home Taxpayer Advocate Service Tas Taxpayer Advocate Service

Amanda King Stakeholder Relationship Tax Consultant Internal Revenue Service Linkedin

Tax Advocate Group Home Facebook

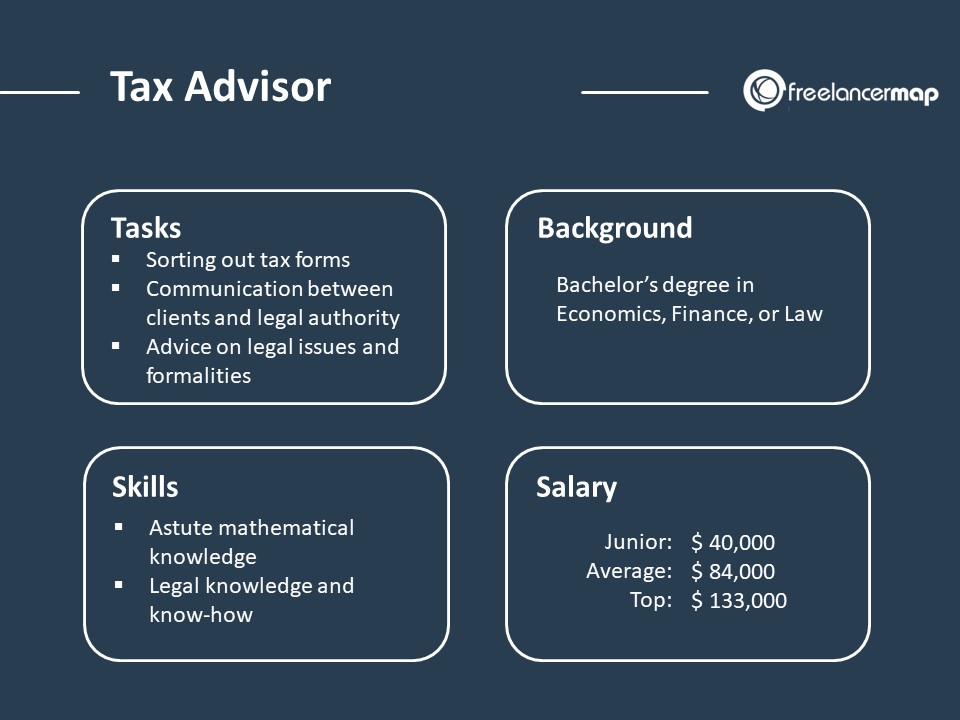

What Does A Tax Advisor Do Career Insights

Irs Hitting You With A Fine Or Late Fee Don T Fret A Consumer Tax Advocate Says You Still Have Options

/ap675784005308-5bfc32af46e0fb00265d3be7.jpg)